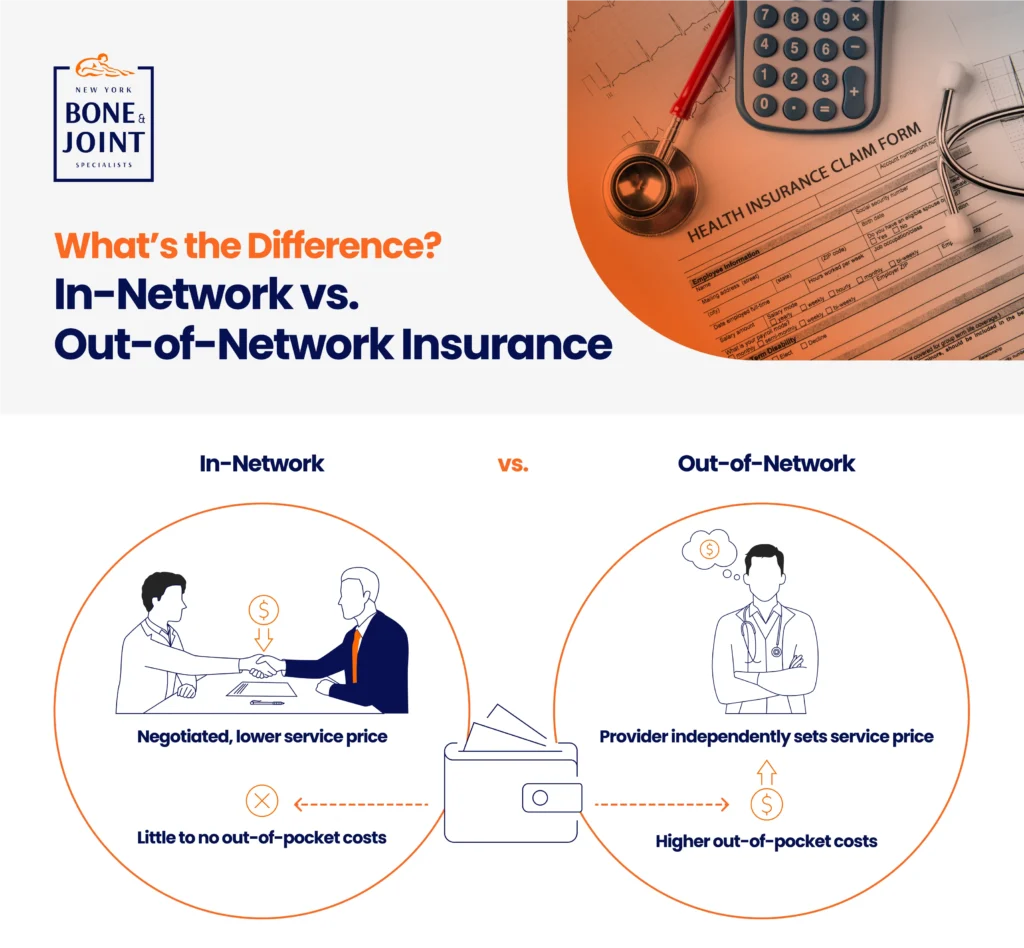

Health insurance can be confusing at times, but this explainer should help you understand in-network vs. out-of-network costs.

Most Americans have health insurance. According to the latest data from the U.S. Census Bureau, 92.1% of Americans, or 304 million, had health insurance at some point in 2022. While having insurance can soften concerns about medical expenses, patients may still find navigating the complexities of health insurance daunting. One of the most frequently asked questions regarding coverage is, “What’s the difference between in-network versus out-of-network insurance?”

At New York Bone & Joint Specialists, we want our patients to get the best possible care, and that means informing you about potential expenses. In this article, we’ll thoroughly review types of health insurance coverage, explain differences in cost, and cover other common questions to help you better prepare for any upcoming appointments.

What is in-network coverage?

In-network coverage means a provider, such as a doctor, facility, or pharmacy, has already agreed to a negotiated price for certain services. For example, say a specific doctor charges $7,000 for surgery. If your insurance considers that doctor to be a part of your healthcare plan or “in-network,” that means the insurer and the provider have both settled on a discounted rate for the operation, say $4,000. Therefore, the doctor will accept the $4,000 payment from the insurer and not bill you the remaining balance.

What is out-of-network coverage?

Out-of-network providers have not signed a contract with the insurer. As a result, they have not agreed to a negotiated price for services. For the same $7,000 surgery detailed above, that means the insurer will pay up to a certain amount, say $5,000, and ask that you pay the $2,000 difference between the doctor’s charge and the negotiated fee. That’s in addition to the deductible, copay, and/or co-insurance costs associated with your plan.

Other factors to consider

With insurance, there are caveats to consider that can impact the type of provider you choose to see. Now that you know the difference between in-network vs. out-of-network insurance, here are some FAQs about the two that can help you decide which coverage route to take:

What will cost more?

In general, going out-of-network will increase your medical expenses. Your insurance carrier may not fully cover the cost of a service or only partially pay for it. Further, your deductible and out-of-pocket maximum may be higher for an out-of-network service or procedure. The out-of-network provider may also bill you for the difference between the doctor’s charge and what the insurer will pay. While some insurance carriers offer out-of-network benefits like coverage for emergency services, not all do, so be sure to look into what your plan provides.

Is it better to go in-network?

Yes, it’s better to go in-network when possible. Your out-of-pocket expenses will be less than out-of-network costs, and in-network providers cannot bill for the difference between the negotiated price and the doctor’s fee for the services. Health insurance companies contract with a wide variety of specialists and facilities, so you should be able to find a doctor you need within the network. But always check with your insurer before making an appointment just to be sure.

Is there ever a time to use an out-of-network provider?

There may be a time when using an out-of-network provider is the better option. For instance, you may want to go to a doctor who you’ve been seeing for some time, even if he or she is out of network. Or you may need an out-of-network specialist. Just be aware by using that provider, your out-of-pocket expenses will be higher than in-network. However, some insurers will allow you to file an appeal to gain out-of-network coverage depending on the type of service and circumstance. Your primary care doctor will typically send that request to the insurance company.

What about emergency services?

Emergency services in an out-of-network facility are generally covered by insurance companies. Many insurance carriers also cover what is known as out-of-network “surprise bills,” or medical bills submitted by an out-of-network provider you didn’t select, such as an anesthesiologist who participated in your procedure that you didn’t pick.

What can patients do?

Ultimately, the decision as to whether to go in-network or out-of-network is up to you as the patient. Before you make an appointment or schedule a procedure, review your health insurance policy to determine who is in-network, what is covered, and what you will pay.

Let us help you

As a leading sports medicine center, New York Bone & Joint believes taking care of patients also means alleviating their financial burden when possible. Our staff will help you know your costs and develop an affordable payment plan so you can get the care you need. To see a complete list of accepted insurance plans, please click here. For further questions, feel free to give us a call at (212) 759-4553.